BIZ-OMICS

Business Studies: Ratio and Investment Appraisal Calculator

Business Studies: Ratio and Investment Appraisal Calculator

Couldn't load pickup availability

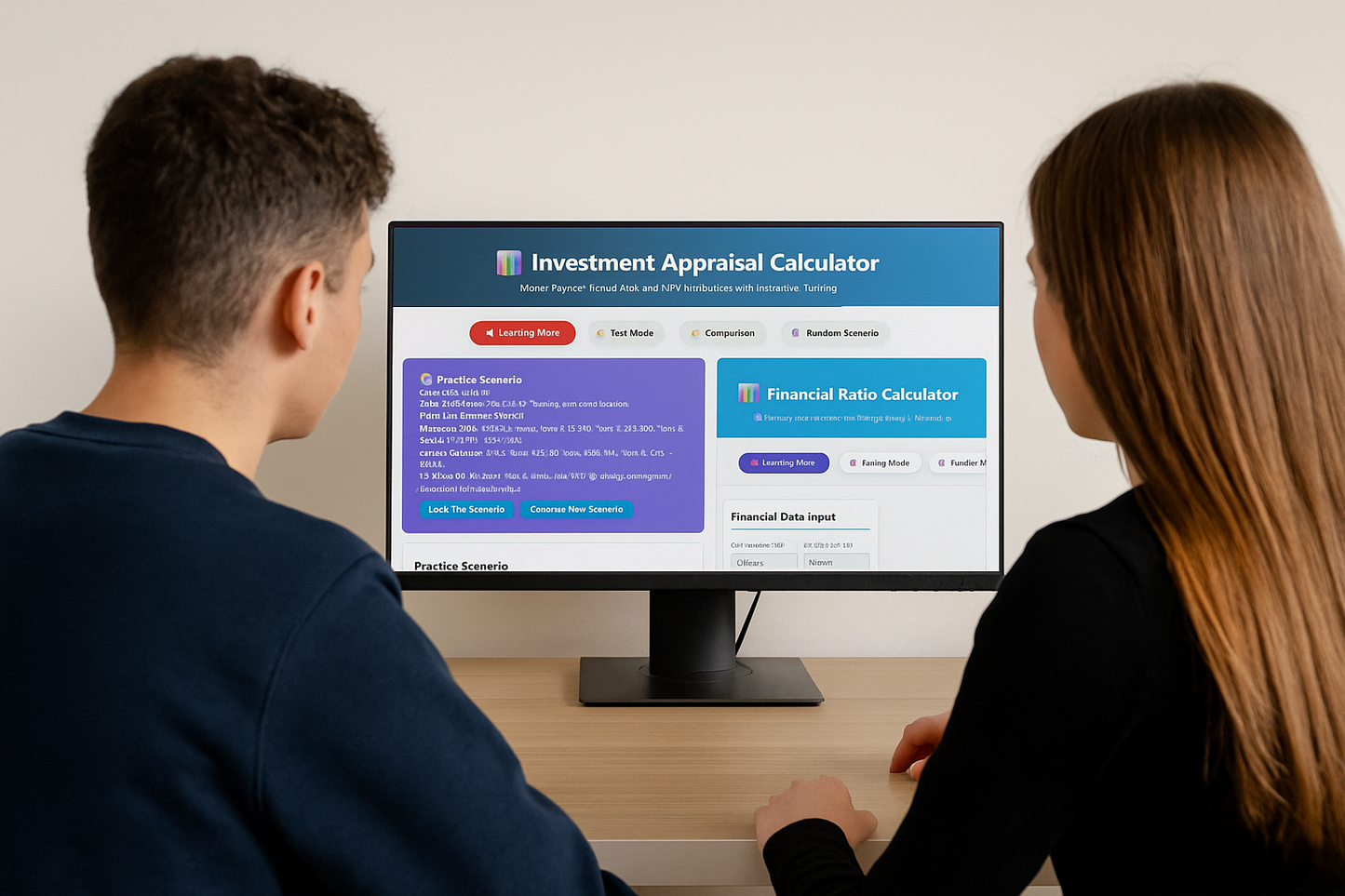

This interactive bundle combines an Investment Appraisal Calculator and a Financial Ratio Analysis Calculator, giving students tools to master methods such as payback, ARR, NPV, and key profitability, liquidity, efficiency, and gearing ratios.

The Investment Appraisal Calculator

The Investment Appraisal Calculator is a full-featured interactive tool designed to teach and practice three core investment appraisal techniques: payback period, average rate of return, and net present value. It allows the learner to input an initial investment, discount rate, residual value, and a series of cash inflows, before automatically producing results with step-by-step working and clear interpretation. The tool not only shows whether a project should be accepted or rejected but also provides reasoning, such as whether the payback time is attractive or whether the ARR meets a benchmark. The benefit of this design is that it goes far beyond static worked examples: learners can experiment with different figures, see instantly how results change, and understand the mechanics of discounting or depreciation through the detailed workings generated. The learning outcomes include being able to correctly calculate the three appraisal measures, interpret the financial meaning of results, and apply decision-making rules in line with most exam-board expectations. In addition, the test mode and random scenario generator ensure that students can move from guided practice into more independent problem-solving, building both fluency and confidence.

The Financial Ratio Calculator

The Financial Ratio Calculator is a sophisticated analysis and practice tool that covers the key ratio groups required for AQA Business: liquidity, profitability, efficiency, and financial structure. Students can either enter their own data or generate practice company accounts, from which the calculator produces ratios such as current ratio, acid test, gross and net profit margins, ROCE, inventory turnover, receivables and payables days, gearing, and debt-to-equity. Each ratio is accompanied by the formula, the working steps, the correct interpretation, and in testing mode, an opportunity for the learner to calculate and check their own answers against the model solution. The main benefit is that it moves ratio analysis from abstract formulas into a dynamic experience where learners can manipulate figures, diagnose financial strengths and weaknesses, and immediately see how ratios link to business decision-making. The learning outcomes are a secure understanding of ratio formulas, the ability to interpret ratios in context rather than simply calculate them, and practice in making evaluative judgments about liquidity, profitability, efficiency, and financial risk, all of which are essential skills in preparing for examinations and for applied business analysis.

Together these two HTML tools provide a complementary learning experience, one focusing on investment decisions and long-term appraisal methods, the other on interpreting business performance through ratios. They reinforce calculation accuracy, promote evaluative thinking, and allow students to engage with realistic business data in an interactive and motivating way.

Share