BIZ-OMICS

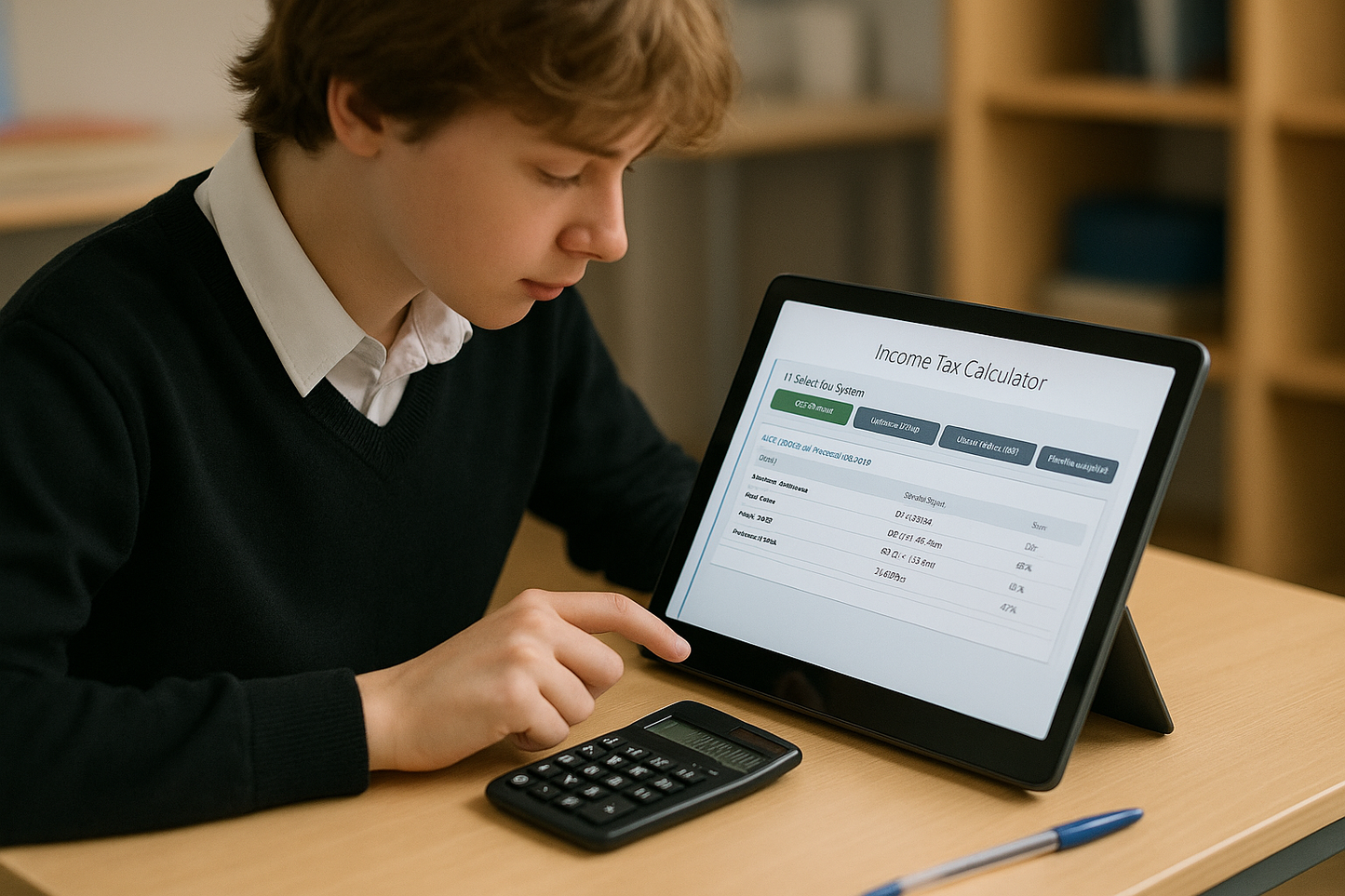

Economics: Income Tax Calculator

Economics: Income Tax Calculator

Couldn't load pickup availability

An interactive app that lets students:

choose a tax system (rUK 2025/26, Scotland 2025/26, Labour/Corbyn 2017, Truss/Kwarteng 2022),

set an annual income via slider or quick occupation buttons,

click Calculate to see Gross, Tax, Net, and Effective tax rate, and

Read a step-by-step calculation breakdown showing how each band contributes to the total.

Learners calculate progressive tax and verify sums using the transparent band-by-band breakdown.

They interpret effective vs marginal rates (e.g., why the effective rate rises more smoothly than the marginal rate steps).

Students compare systems (rUK vs Scotland vs historical proposals) and evaluate policy trade-offs (more bands vs fewer; rate changes vs thresholds).

They investigate tapering above £100k and discuss equity vs efficiency implications (e.g., behavioural responses around the taper zone).

The HTML is accompanied by a PDF worksheet providing ideas for classroom use.

Share