BIZ-OMICS

Economics: Fiscal Policy Simulators

Economics: Fiscal Policy Simulators

Couldn't load pickup availability

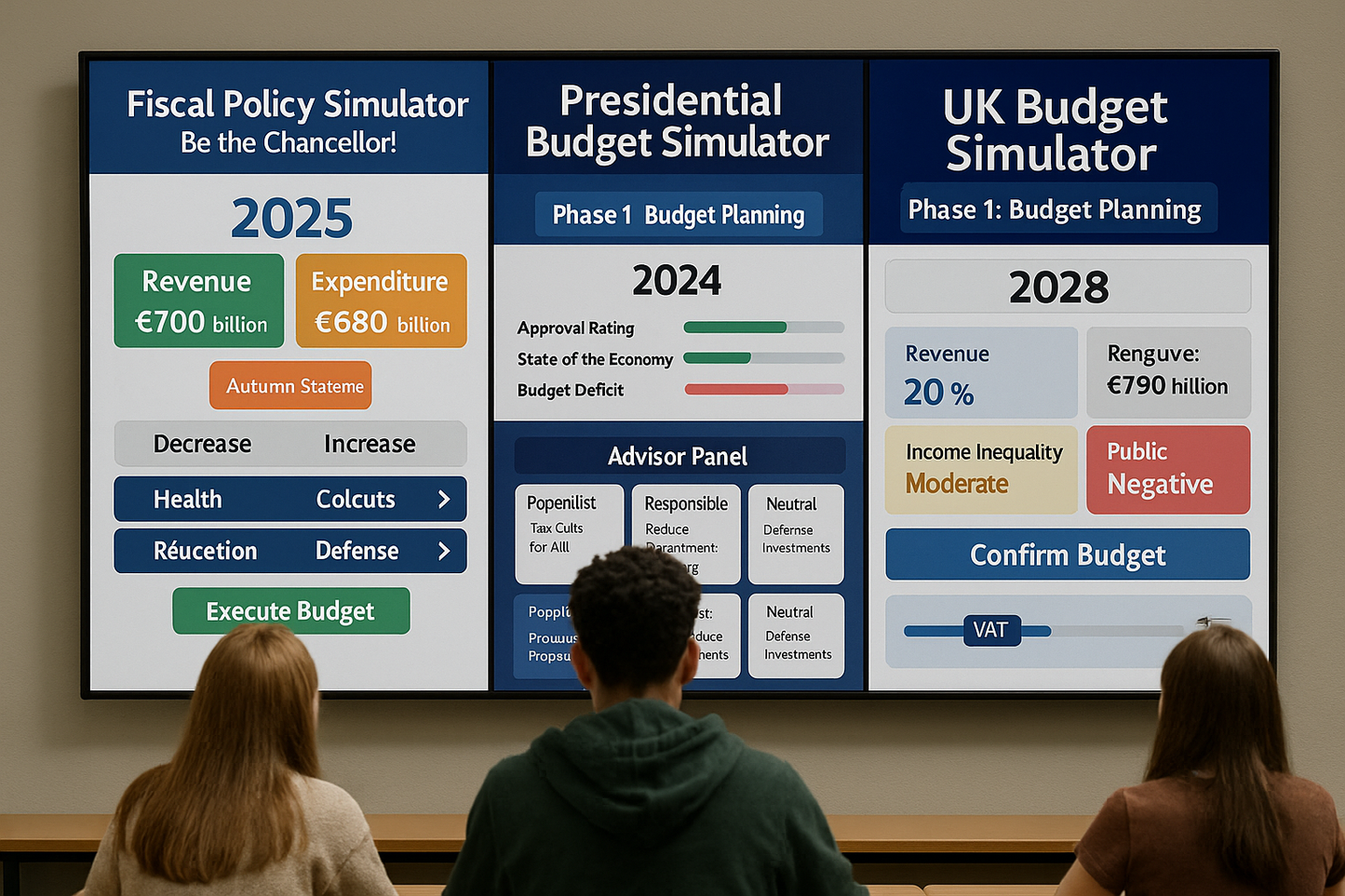

Fiscal Policy Simulator – Be the Chancellor!

Step into the Chancellor's shoes and deliver the UK’s Spring or Autumn Budget. This interactive simulation allows students to adjust tax rates and government spending across sectors like NHS, education, defence, and transport. As the simulation unfolds, learners witness real-time changes to key indicators such as public approval, NHS satisfaction, GDP growth, and inflation. A powerful tool for applying theory to realistic fiscal dilemmas, it reinforces economic trade-offs and public finance principles through dynamic stakeholder feedback and multi-year outcomes.

This HTML simulator is accompanied by a supporting PDF document, designed to help teachers integrate the resource effectively into the classroom with ideas for use, key discussion questions, and reflection prompts.

Key Learning Outcomes:

Understand budget balancing through tax and spending decisions

Analyse the macroeconomic impact of fiscal policy (GDP, inflation, unemployment)

Evaluate stakeholder reactions from the public, media, markets, and institutions

Crowding In & Out Visualiser

This interactive resource, the Crowding In/Out Effect Visualiser, is designed as both a teaching and learning tool to help students explore the complex relationship between government deficit spending and private sector investment. It provides a dynamic way of visualising the economic concepts of crowding out, which occurs when the economy is operating at full employment, and crowding in, which emerges when spare capacity exists. Rather than relying solely on static diagrams in textbooks, this resource allows learners to manipulate variables directly and see in real time how economic choices and trade-offs play out along the production possibility frontier (PPF).

The visualiser is split into two main sections: one dedicated to crowding out and the other to crowding in. In the crowding out section, learners adjust sliders to represent government spending and private investment when resources are fully employed. They can immediately see how increased government borrowing shifts the position along the PPF, highlighting the direct trade-off between public and private spending. This builds understanding of opportunity cost, resource allocation, and the constraints of full employment. The crowding in section instead focuses on economies operating below capacity. Here, learners begin with lower levels of spending and can activate the “accelerator effect.” This step-by-step simulation illustrates how government stimulus can spark private sector optimism, increase investment, and push the economy closer to full capacity. By experiencing the accelerator principle in action, students can develop a clearer sense of how fiscal policy can drive multiplier effects in practice.

The resource is enhanced further with explanatory tabs that guide learners through the mechanisms behind each effect, alongside a dedicated theory section. Here, students are introduced to the contrasting perspectives of Keynesian, Monetarist, and Neo-Classical schools of thought. Each perspective is clearly explained, allowing learners to compare and evaluate differing economic arguments. This provides a platform for higher-level critical thinking, as students are not only observing how the mechanisms work but also engaging with the theoretical debates surrounding the effectiveness of government intervention.

The Government Expenditure Game

The HTML file functions as an Advanced Fiscal Policy Simulator that immerses learners in the role of Chancellor managing a £750bn budget. It begins with an introduction and short theoretical overview, before moving into an interactive dashboard where spending can be allocated across categories such as healthcare, education, infrastructure and welfare. Sliders allow adjustments, and the effects on indicators like GDP growth, unemployment, inflation and debt are updated instantly. A theory panel offers Keynesian, Monetarist, Supply-Side and Austrian perspectives, while the results screen provides metrics and written analysis of fiscal stance, multiplier effects and crowding out.

The benefit of this structure is that it transforms abstract fiscal theory into a practical decision-making exercise. Learners test choices, receive immediate feedback and compare outcomes across theoretical frameworks. Visual dashboards, numerical indicators and textual explanations work together to reinforce understanding and appeal to different learning styles. The resource also encourages repetition and experimentation, which deepens engagement and promotes critical thinking about trade-offs in public spending.

The main learning outcomes are that students gain a secure understanding of government expenditure categories, apply economic theories in context, and analyse the impact of fiscal policy on key indicators. They also learn to evaluate policy trade-offs, strengthening their ability to construct analytical and evaluative responses in line with A-Level assessment objectives.

Presidential Budget Simulator – Lead a Nation for Four Years!

Designed to replicate the pressures of U.S. presidential leadership, this engaging simulator lets students navigate 16 budget cycles over a 4-year term. With each quarter, they select policies—from tax cuts and infrastructure to deficit reduction and tech regulation—facing real consequences in approval ratings, economic health, and the budget deficit. Advisors offer strategic commentary, while unexpected events like bank failures or hurricanes test students’ responsiveness. Perfect for civics, economics, and politics courses, this tool cultivates critical thinking, decision-making under pressure, and political realism.

This HTML simulator is accompanied by a supporting PDF document, designed to help teachers integrate the resource effectively into the classroom with ideas for use, key discussion questions, and reflection prompts.

Key Learning Outcomes:

Make policy trade-offs between popularity, economic performance, and deficit control

Explore the effects of populist, responsible, and neutral fiscal approaches

Respond to crises and events with adaptive decision-making

UK Budget Simulator – The Chancellor’s Challenge - The Laffer Curve!

This powerful UK-focused simulation puts the Laffer Curve into motion. Students adjust income, VAT, and corporation tax rates while seeing instant feedback on GDP, compliance, and revenue. Each year, they can select from authentic UK fiscal scenarios (e.g., “High-Tax Social Democracy” or “Post-Brexit Growth”) and activate optional policies like Digital Services Taxes or HMRC transformation. With a dual-phase structure—planning and results—students experience the real impact of fiscal decisions through animated charts and economic events. Ideal for A-Level Economics or Politics, it transforms abstract models into living, analytical experiences.

This HTML simulator is accompanied by a supporting PDF document, designed to help teachers integrate the resource effectively into the classroom with ideas for use, key discussion questions, and reflection prompts.

Key Learning Outcomes:

Apply Laffer Curve theory in a practical, scenario-based setting

Investigate relationships between tax levels, compliance, and GDP

Understand policy complexity in public approval, tax yield, and compliance

The Bond Market Simulator

The Historical Bond Market Crisis Simulator is a polished, classroom-ready HTML app that lets learners feel the whiplash of real sovereign debt shocks—then see the maths behind the mayhem. Pick a headline event like the UK’s 2022 mini-budget, Greece’s 2012 peak, Russia’s 1998 default, Argentina’s crises, Brazil 2002, or Turkey 2018, hit “Trigger Crisis Event,” and watch stable markets flip to “peak panic” with live updates to yields, prices, confidence and market stability. A responsive before/after dashboard and a bonds portfolio view make the inverse price–yield relationship visceral: existing bonds reprice using a built-in valuation engine (present value of coupons and principal), while a “New Issue” card shows the sharply higher coupon governments must offer to borrow post-shock. A bold alert banner quantifies the spike in borrowing costs, and an explanatory panel ties the mechanics to fiscal credibility, market access, and feedback loops—perfect for A-Level or introductory university economics and finance. Crafted with clean gradients, gentle micro-interactions and mobile-first layout, it’s ideal for lesson starters, flipped learning or quick assessments, and it resets instantly for repeated demonstrations or comparisons across crises

The Economic Automatic Stabilizers Simulator

The Economic Automatic Stabilizers Simulator is a clean, classroom-ready HTML app that turns abstract fiscal mechanics into a living, visual story. Choose a scenario—UK 2008–2010, COVID-19 2020–2021, or a pre-crisis “normal”—then pick your analysis lens: automatic stabilizers only, with discretionary policy layered in, or a side-by-side comparison. Hit Run to animate real-world dynamics across quarters: GDP growth and unemployment trace the shock, while tax revenue and government spending lines reveal how receipts fall and welfare outlays rise automatically. A live metrics deck translates movement into meaning with fiscal balance, debt-to-GDP, stabilizer intensity and discretionary spend, and an explainer panel grounds the visuals in official UK sources. Toggle the Real Data Info drawer to surface crisp, contextual facts—VAT plunges in lockdowns, corporation tax collapses in recessions, claimant counts surge—then pause or reset to re-run the narrative from a different angle. Built with a responsive, mobile-first layout, subtle gradients, and smooth chart animations, it’s ideal for starters, flipped learning and quick assessments, helping students see how counter-cyclical fiscal design cushions downturns before politicians even lift a pen.

Share